The complexities of body electronics today and tomorrow

April 27, 2015

Body electronics systems embrace a wide variety of applications, addressing everything from driver and passenger comfort and security to high-performa...

Body electronics systems embrace a wide variety of applications, addressing everything from driver and passenger comfort and security to high-performance computing and in-vehicle networking. Even with such a broad range of offerings, customers still expect reasonably priced electronic components with the highest levels of both quality and reliability. As consumer expectations continue to rise, so do the complexities of these systems. In this article we will discuss trends in body electronics today, the complexities arising from these trends, and the industry outlook for this market.

Today’s trends and challenges

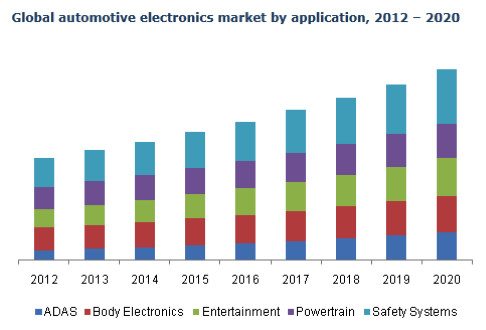

According to a new study from Grand View Research, the global automotive electronics market is expected to reach USD 279.96 billion by 2020, and body electronics technology was identified as one of the drivers of this projection (Figure 1). The body electronics market is highly competitive, and there are several trends being experienced as a result. Helping fuel these trends is an increase in the amount of data that needs to be processed in the vehicle. Many of today’s modern cars, for instance, are using advanced driver assistance systems (ADAS) and there has also been an increase in connectivity between consumer devices like mobile phones and the automobile. From a conceptual perspective, there’s also been much discussion about vehicle-to-vehicle (V2V) communications.

|

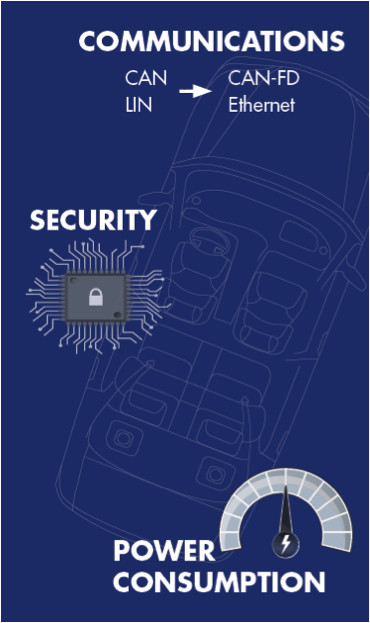

Now let’s take a closer look at some of the key trends (Figure 2):

|

- Communication infrastructures are changing:Traditional bus systems like controller area networks (CAN) and local interconnect networks (LIN) enable microcontrollers (MCUs) and devices to communicate with each other. Today, however, there is an increase in the demand for CAN FD (flexible data rate), which has a higher bandwidth able to accomodate the increase in data described previously, as well as an increase in the use of Ethernet. Ethernet is not new, but in recent years the automotive industry has been examining this option more closely because of the affordability of unshielded twisted pair (UTP) cabling technology.When you think about gateway applications between buses, additional complexities arise as you shift from one to another in order to ensure data consistency at all points. Beyond acceptance and data consistency, the challenge with introducing new bus systems is the same as it always has been for this industry – each new bus system will introduce a new dimension of complexity, such as different bulk rates in CAN FD. This is something the industry will need to overcome in the near term.

- Data security and growing software complexity: As discussed, we are experiencing a data explosion in automotive electronics. With that, we see software demands the demand for software code and services continuing to grow as well. With critical data being transmitted through the whole system bus, security has also become even more important. Complex algorithms like the advanced encryption standard (AES) are now being used, and hardware support is also required to encode and decode data in real-time. Companies like Cypress that can reduce complexity and shorten time to market by acting as a one-stop shop when it comes to both hardware and software integration solutions will have an advantage.

- Low power consumption: The number of electronic control units (ECU) within automobiles has greatly expanded in recent times. Low power for standby and normal ECU operations is no longer an option, but a very important requirement in body electronics. Designers are faced with the challenge of maximizing functionality while maintaining the total current demand below the fixed limit of the battery’s power. At the same time, more and more OEMs are looking to consolidate ECUs – all of which will lead to an increased focus on the benefits of multicore chips.

The proliferation of these trends is leading to several challenges for automakers, especially as many OEMs try to navigate the new intricacies of the automotive domain. Additionally, where OEMs are concerned, there are many different possible E/E architectures to consider, and each of these comes with its own set of requirements. For the manufacturers of vehicle technology it’s very difficult to have a single line-up that caters to all these requirements at once. While some challenges will be unique to the particular OEM, some will remain consistent across the entire market, such as network bandwidth, low power, high performance, and security. It’s all about having the necessary horsepower at the right power consumption, all at the right price point.

Where do we go from here?

Automobiles will continue to evolve to provide even more comfort, connectivity, and convenience than before. This rapid change requires more complex systems with higher performance. New generations of electronics — and in particular MCUs — are required to deliver high performance, robust security, and advanced networking protocols tailored to body electronics. The emphasis on low power that we’re seeing today won’t be going away anytime soon either, especially with the growing popularity of hybrid and electric vehicles (HEVs/EVs).

OEMs will continue to look at ECU consolidation, the key to which is high-performance devices based on multicore architectures. Another key enabler is Flash memory, a good example of which is the convenience that over the air (OTA) updates can deliver. During an OTA, the vehicle has to download software that must be programmed in an ECU, a process that may take several minutes. While that may not seem like a lot of time, it can be an eternity when considering that the car may not be able to used during an update. One way to alleviate this issue is by doubling of the amount of memory in the ECU so it can perform the update without needing to shut down other functions of the car.

Another trend is even more collaboration across the entire ecosystem, with companies working together at a level that they have not committed to in the past. No single company will be able to overcome all the complexities of body electronics on its own. Some companies are investing in both competing and complimentary ecosystems, like the ARM ecosystem. Today, ARM and its wide network of partners, including Cypress Semiconductor, are working together to deliver the level of reliability and performance needed by automotive manufacturers.

Today’s trends are tomorrow’s solutions

Just like every other industry, body electronics is – and will continue to be – ever changing. Strategies like migrating to ARM-based body solutions contribute to easing some of the complexities associated with body electronics, and help future-proof the architecture decisions of compute elements. ARM’s technology can now be found in smartphones, wearable fitness trackers, thermostats, and yes, even cars. As a part of the ARM ecosystem, companies like Cypress have been able to deliver offerings like the Traveo family of MCUs based on the powerful ARM® Cortex®-R5F core in single- and dual-core operation, which offers state-of-the-art real-time performance, safety, and security features. This family offers high performance graphics engines optimized for a minimum memory footprint, and embeds dedicated features to increase data security in the car.

Though there are a number of complexities for automotive body electronics, you can bet your dollar that more companies will collaborate to deliver the best solutions available. I may not be a fortuneteller, but I think we are all in for an exciting body electronics ride.

Cypress Semiconductor

www.cypress.com